There are two main disadvantages to presenting digital purses than it is to bucks otherwise an actual physical card. Samsung Pay has comparable technical featuring however, was made to possess pages and then make payments using Samsung cell phones or any other Samsung devices. Digital purses may also store things such as present cards, knowledge entry, airline tickets, membership cards and. Similarly, the knowledge kept to the those things will be electronically transmitted when you’re ready to make use of them.. Advertising served for the the account by these firms do not incorporate unencrypted personal data so we reduce entry to private information by the companies that suffice the advertisements.

Simple tips to get in touch with Bing Spend customer service: check here

Many of these apps give a convenient means to fix mix all the your hard earned money or store present notes. Constantly you just have to breeze a picture of the cards and perhaps enter a password to make the currency made available from the fresh payment software. One more thing to be on the lookout to own with your features is getting money otherwise requests funds from those you don’t understand.

Discover your own nearby store

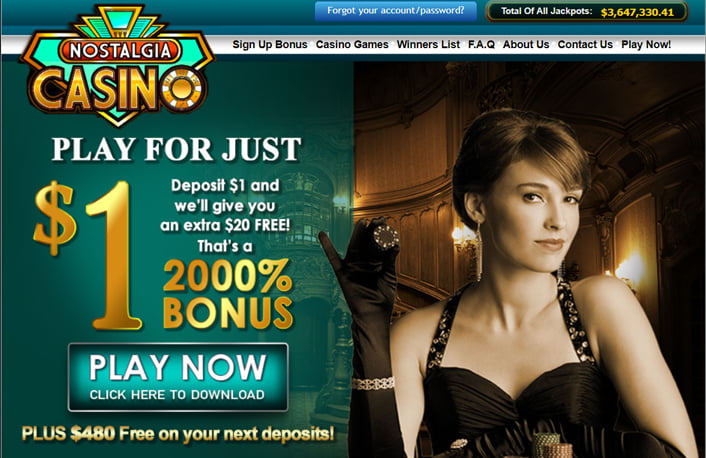

When a great consumer will bring the commission information or other sensitive personal info to complete a purchase, a secure checkout an internet-based percentage approach will help protect its study. And make portable money, you will want to find a betting site which allows its users to help you put using cellular telephone costs credit. You can find a reliable pay by the mobile playing web site from the listing of an informed sportsbooks on this page. Cell phone expenses placing is simple since you wear’t have to see plenty of standards to begin with.

Instead of a merchant account in order to deposit to the, the new local casino can be’t import their winnings. Therefore, for individuals who deposit playing with Pay by the Mobile phone, you’ll you desire another way of withdraw the earnings. Unfortuitously, Shell out by the Cell phone doesn’t service withdrawals as the charge is actually placed into your own month-to-month cellular telephone expenses. Inside a short time, you’ve effectively topped your on-line casino account and certainly will now delight in your preferred games for example Blackjack, Roulette, otherwise Baccarat straight away.

The new portable defense given by any of these cards is different from the fresh warranty exposure some cards give. Since 2024, the typical expenses for a mobile phone plan stands during the check here $144 30 days otherwise $step 1,728 per year, centered on CNBC. TPG values Best Advantages items at the a substantial dos.05 cents apiece, meaning from the step 3 points for every money, you will get in the $106 inside the value per year by simply paying the cell phone bill which have that it cards. While the Ink Team Common Bank card now offers bonus things to your office-relevant spending, it’s a fits to own small-business owners. During the TPG, all of us are in the enabling customers see a method to maximize all of the purchase it is possible to, from your each day latte run to the monthly mobile phone expenses.

Zelle is yet another big name, which has strong links with lots of of the most important banking companies within the the country. While the application is initiated, you’ll manage to use it any kind of time compatible critical. Faucet otherwise simply click to see all the stuff you can do which have Google Shell out. If the application demands your create a credit, follow the onscreen recommendations. If the unit spends Contact ID, you’ll test your digit to continue. This really is section of Fruit Shell out’s encoding, and this spends the biometric investigation to help avoid con.

Rectangular has transparent, easy-to-know percentage running costs for how the new product sales is done plus the sort of fee put. Square possesses repaid put-ons, for example payroll, e-mail marketing, and you can state-of-the-art POS solutions for merchandising and you may eating service. This type of add month-to-month will cost you but they are however very as effective as most other home business POS systems, specially when you cause of the free equipment Square delivers. Since the pandemic, of several stores already don’t deal with dollars, and some believe the fresh development will continue.

Anyone spending your enters the affiliate ID as well as the currency they’lso are delivering. Very percentage applications instantly transfer the money to the equilibrium. You might exit the amount of money from the application otherwise import him or her to help you an outward account. Accessibility 100+ payment actions, in addition to pick today, spend after options that may increase qualified money by the as much as 14%, and you will financial debits and you may real-day costs that can down deal costs.

This is when material interest starts operating up against you; the newest smaller you pay right back, the more the eye increases, adding extra amounts of money to your account’s harmony that might be repaid. Some tips about what is known as a horrible financial obligation cycle – it simply continues supposed and you can heading unless you remove the balance. And when a difficult credit score assessment occurs, it is advertised so you can credit agencies, that can impact your credit score.

You can also be able to pay for on the web purchases with a bank account. After you put money having a wages because of the cellular phone gambling establishment it differs to presenting a credit card otherwise a payment chip including Skrill. There’s no interaction together with your savings account after all when you will be making deals.

From path dinner to shopping, sightseeing, and you will vocal bedroom, spending cash inside Korea doesn’t should be difficult. Revolut the most flexible options for animated money and you may purchasing requests. You could posting currency worldwide and found money inside twenty five+ some other currencies. Most people shop on the internet having a cards or debit credit, electronic handbag otherwise mobile percentage provider. However, if such aren’t your preferred steps, you’ve got other available choices.